Let’s face it. Some of the biggest headaches in adulthood come from taxes. Whether you’re paying them or filing them, they are just the worst. Fortunately, the right tax software can make them suck a little less. We’ll take a look at one of the top tax preparation companies with this TurboTax review.

Nobody wants to spend unnecessary time on their taxes, and that includes time spent finding the right software. We’re here to save you time by examining the fees, notable features, and accuracy all in one post.

To keep things simple, we’re just going to look at TurboTax Online. That being said, they do have software available for download. If you prefer this method, it’s good to know that you can return any purchased software for a full refund (excluding any shipping and handling costs).

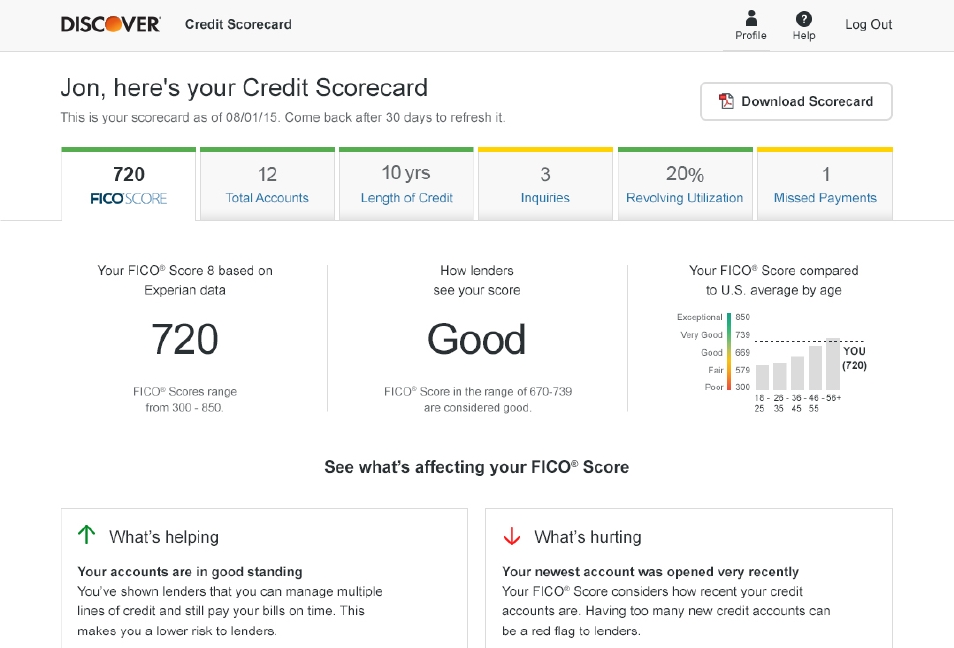

Credit Karma has a brand-new checking account that's available to TurboTax customers before anyone else Laura Grace Tarpley, CEPF 2021-02-11T21:45:51Z. In brief, a high credit score improves your chances of getting approved for loans, mortgages, and credit cards. Lenders earn big earnings when they provide the loans, however there are also moments of unrest proven behind too. Moderate credit balance whereby payments are made commonly is ideal in getting higher scores.

Before we dig into all the details, it’s good to know about who TurboTax is.

Free Filings:

Simple federal and state

Document Import:

Previous returns, W-2, 1099

Promotion:

Start Filing

Return Status:

Check eFile status, track IRS refund, and previous year's return

Professional Assistance:

Talk live with tax experts

Audit Support:

Free, year-round guidance

Full-Featured App:

Android, iPhone

Free Filings:

Federal

Document Import:

Prior year's return; from TurboTax, H&R Block, and TaxAct

Promotion:

Direct E-file to IRS

Return Status:

Check eFile status, track IRS refund, 7-year access to returns

Professional Assistance:

Email support; live tax expert chat included with Deluxe plan

Audit Support:

Included with Deluxe plan

Full-Featured App:

No

Free Filings:

Simple federal and state

Document Import:

TaxAct, TurboTax and H&R Block returns; W2 import; 1040, 1040A, and 1040EZ froms

Promotion:

Refer friends. Get Amazon gift cards.

Return Status:

Check eFile status, track IRS refund, 7-year access to returns

Professional Assistance:

Tax specialist phone support

Audit Support:

Available for purchase

Full-Featured App:

Android, iPhone

About TurboTax

TurboTax is under the umbrella of companies that Intuit Inc. owns. Do you use QuickBooks or Mint? Intuit runs those too, and you can use the same login information for all of them.

Scott Cook and Tom Proulx founded Intuit in 1983. Fun fact: Cook still works with Intuit as the Chairman of the Executive Committee, meaning he runs the committee that runs the entire board.

Intuit went public in 1993 and now has over 9,000 employees with 19 locations in 9 different countries. They boast having over 50 million customers.

As we’ll see later, they make up for their lack of physical locations by dominating the technological world.

If innovation and being woke are important to you, TurboTax is a fair option. Sasan Goodarzi is the current CEO and has stressed the importance of social awareness and fair representation.

TurboTax Guarantees

TurboTax boasts four main guarantees:

100% Accurate Calculations – TurboTax will pay any penalty or interest resulting from a calculation error by its software.

Maximum Refund Guarantee or Your Money Back – TurboTax will refund any of their fees if you can get a larger refund with different software. If you used the Free Edition, TurboTax will pay you $14.99.

Audit Support Guarantee – By using TurboTax, you qualify for year-round help understanding any notices or letters from the IRS or state departments. This does not mean they will represent you in an audit. They’ll just help you understand why you’re being contacted or audited.

100% Accurate, Expert-Approved Guarantee – This one is similar to the 100% Accurate Calculations Guarantee. If any of TurboTax’s employees make an error on your return, TurboTax will pay the resulting penalties and interest.

These guarantees are great perks, but they’re pretty consistent with competitors like H&R Block. They’re good to know about but shouldn’t be your deciding factor.

What does make these guarantees useful is that they instill a good deal of confidence while scrolling through TurboTax’s website. Reading about tax experts reviewing returns and guaranteeing that they’re done correctly takes away some of the stress that comes with filing taxes.

Just remember that this doesn’t necessarily mean you won’t have any errors on your tax return. It just means TurboTax will pay the penalties and interest for any problems on their part. But that’s still a pretty good perk.

TurboTax Free Edition

TurboTax is one of the few companies that offers a completely free option. Your federal filing is free. State filing is free. Everything is free.

But this means you have to ignore all of the add-ons that TurboTax will try to sell to you, which we’ll discuss in more detail later.

The only downside to this free filing is the fact that only the simplest of returns qualify. According to TurboTax, you qualify if your tax return only includes the following:

- W-2 income.

- Small dividends and interest.

- Standard deduction (as opposed to itemizing).

- Earned Income Tax Credit (EITC).

- Child Tax Credits.

You can’t have any other Schedules, including Schedules A, C, D, E, and 1-6. This hurts because Schedules 1-6 contain many of the items that used to be on the 1040 before the postcard 1040 in 2018.

If you have student loan interest, educator expenses, Health Savings Account contributions, or other similar deductions, you can’t use the Free edition.

Yet another reason why student loans are the bane of my existence.

TurboTax estimates around 50 million people qualify for their Free Edition. If you qualify, you’re able to use their quality software with none of the fees. None.

Tweet ThisI’m jealous.

File for a Fee

For those of you who can’t use the free version, you have a handful of other packages to choose from:

TurboTax may dominate with their Free option, but their paid options are a bit pricey compared to the competition. Even the Deluxe package, which is the next step up from Free, is going to cost you over $100 to file both a federal and state return.

With all of their packages, you have the option of making them Live versions for an increased fee. This means you’ll have a tax expert available to help you while you complete your return.

This Live feature also grants the ability to ask unlimited questions for the entire year after you file your taxes, and they’ll review your return before you file. While Live is expensive, it’s a pretty cool, unique feature. When you ask questions, you’ll even be able to see your tax expert right on your screen.

Is It Worth Paying For?

Each package comes with its perks. Choosing the Deluxe option allows you to have 24/7 access to your tax return. This saves you from having to keep a personal copy, even though you should still do this.

With TurboTax Premier, you can report cryptocurrency gains and losses. Cryptocurrency is still new to many tax preparation companies, so TurboTax is taking the lead in this situation.

For TurboTax Self-Employed, you’re going to pay $165 if you file both federal and state returns. The benefit here is that as of the writing of this article, TurboTax offers a free subscription to QuickBooks Self-Employed when you pay for the Self-Employed tax package.

This only applies if you don’t already pay for QuickBooks Self-Employed.

This QuickBooks subscription can easily cost you $120 per year. If you’re considering using QuickBooks for your self-employment earnings, getting the free subscription with your tax return is a phenomenal deal. Plus, you can transfer all your expenses and mileage to TurboTax when it’s time to file your taxes next year.

You can counteract these fees by promoting TurboTax. If you get someone to file using TurboTax, you’ll get a $10 Amazon gift card. You can do this up to 20 times, and your friend will even get a 20% discount when they file their federal return.

If you’re in the military, TurboTax has some awesome discounts. Anyone in the E1-E5 pay grades can use the Deluxe version for free.

If you need a more advanced package, you’ll get $5 off any federal product. This $5 discount also applies to pay grades E6 and above.

Once you enter your military W-2, TurboTax will use that to verify your rank and will apply the discount automatically.

A Tip Before Getting Started

While you can start any TurboTax product for free, it’s hard to automatically downgrade from any of the paid versions back to the Free Edition. Because of this, start with the Free Edition and work your way up.

TurboTax will notify you if you’ve selected something that requires a higher tier of software. So if you start with the most basic version, you can work your way up as needed. This also prevents you from selecting a more expensive package with unnecessary tax forms.

This is important because TurboTax has a way of helping you select which software you need. It’ll ask you easy questions like whether or not you have kids or have rental property. It also asks you if you want to maximize your tax deductions and credits.

No shit. Everyone wants to do this. But the tricky thing in selecting this option means TurboTax will recommend the Deluxe version for the Schedule A itemized deductions.

Since the standard deduction was increased to $12,000 for individuals and $24,000 for married couples in 2018, many people don’t need to itemize deductions and will just use the standard deduction.

This means you could select TurboTax Deluxe and then never actually use the additional forms you’re paying for. And if you aren’t a tax pro, you might not realize the difference between which forms you’re paying for and which forms you need.

Don’t worry about missing out on credits and deductions either. With the Free Edition, I was still asked the same questions about itemized deductions and could have switched to the Deluxe version if I needed to.

Start with the Free Edition. I repeat. Start with the Free Edition.

Additional Fees

Now that we know how to make TurboTax cheaper, let’s see how they’ll try to make it more expensive.

Pay with Your Refund ($39.99)

If you want to pay your filing fees in the future, you can pay them with your refund.

If you don’t have the money now, this is a helpful option that’s similar to the competition. Otherwise, avoid this upcharge by paying your fees upon filing.

Plus ($29.99)

Plus is an option when you file with the Free Edition. It offers all of the perks that the paid versions provide without paying for the schedules and forms your tax return doesn’t need:

- Tech support right on your screen.

- Tips and tax advice for how to maximize your refunds in the future.

- Insights into what impacts your current refund or balance due.

- Easy online amend for up to three years to fix any errors on your part.

- 24/7 access to your federal and state tax returns.

- Access to MyDocs to store copies of your tax documents, such as your W-2.

These are all nice, but they’re not worth it if you can keep solid records for yourself.

MAX Defend & Restore ($49.99)

This comes with several benefits:

Audit Defense – This is audit representation, meaning they will take care of the audit for you. Not every company does this. Some even act as a middle man and will charge to connect you with a representative.

Identity Loss Insurance – TurboTax will reimburse up to $250,000 of stolen money and $1 million for any legal fees you may incur.

Full Identity Restoration – If your identity is stolen, a Resolution Specialist will work with you to recover it.

Identity Theft Monitoring – TurboTax offers 24/7 monitoring and will notify you of anything suspicious. If they find anything, a Resolution Specialist will help you through the process.

Priority Care – This cuts down on wait time when you have a question.

MAX is one of the few offerings that could be worth your money. It’s all insurance in a sense, but $50 is less than a year’s supply of ZzzQuil. If it helps you sleep at night, go for it.

The only negative comes from my personal preferences. TurboTax tried to sell MAX to me twice, and they didn’t mention Priority Care the first time. I’m being petty, but I don’t like consistent sales promotions that leave out all the features.

Getting Started

Not considering costs, is TurboTax any good? Since I work for a CPA firm and am a tax preparer, I’m comfortable with taxes and wanted to put this software to the test for ease-of-use and accuracy.

It’s easy to get started. All you have to do is create an account with an email address, and you’re good to go.

Once you answer some simple questions, TurboTax provides a list of documents you’ll need, such as your W-2 and any 1099’s that may apply. This is an awesome feature that is made even better because it’s done for you with no additional effort.

Doing Your Taxes

The entire process consists of answering one or a few questions per page. This keeps things simple while moving them along at a decent pace.

TurboTax also provides additional insight into more complicated questions, and all the answers show up as either a box or sidebar on your screen. Super useful.

Along those same lines, the software provides insight into some of the changes that happened in 2018. One of my favorites was the way TurboTax provided a little blurb about the elimination of personal exemptions.

I love that they try to inform you of what’s going on instead of leaving you to figure out why your refund is different.

One of the more interesting parts of my taxes was the Retirement Savings Contribution Credit. I was a little worried because it told me I needed to remember to check into this before finalizing my return.

I ignored every attempt they gave me to check this credit and answered every question about this credit as inaccurately as possible. To TurboTax’s credit, it forced me to go back to it after running their CompleteCheck analysis.

I commend them on how they force you to get your credits instead of trusting you to figure it out for yourself.

Is It Accurate?

Yes! TurboTax came up with the same exact refund that I came up with using the professional tax software in my office. It also updates your refund as you go, so you can see how what you’re doing is affecting your taxes.

This was the case even though I tried to answer questions incorrectly to knock off some of the applicable credits and deductions. The software knew I messed up and helped to correct it.

Out of curiosity’s sake, I played around with self-employment earnings. It asked my permission to upgrade to the Self-Employed version, and it calculated self-employment taxes and the new Qualified Business Income (QBI) Deduction correctly.

It even mentioned the QBI Deduction in a list of self-employed tax breaks. I’m super impressed and again commend them for explaining what’s going on with your taxes.

Notable Features

TurboTax values security. You can choose two-factor authentication and Touch ID when setting up your account. TurboTax also encrypts your data both in their servers and when it’s sent to the IRS to keep your personal information safe.

You can also view any devices used to access your account, and you’ll get email notifications when any device is added or when any changes are made to your account.

If you’re into mobile apps, they have three: TurboTax mobile, TaxCaster, and ItsDeductible. These will let you file your taxes, get a refund estimate, and keep track of your deductions throughout the year, respectively. All three are free to download.

For no additional fee, no interest, and no hit to your credit score, you can use Refund Advance to get an advance payment of your refund. This usually applies early in tax season. Amounts range from $250 to $1,000 depending on your federal tax refund, and TurboTax pays themselves back when your refund is processed.

If you’re like me and are impatient when it comes to getting your refund, there’s an Amazon Alexa Skill for that. You can ask how much your refund is, when it’ll show up in your bank account, and the status of your tax return all without having to use the IRS website.

One of TurboTax’s strong suits is the forum. You can ask questions about TurboTax support or tax laws and view questions that have already been answered.

While some of these questions can help you regardless of which company you use, the advantage goes to those who use TurboTax. It’s common to see a question like “Where do I enter self-employed mileage?” There’ll be an answer saying exactly how to find it, so you don’t have to wait for tech support’s help.

Is It Right for You?

TurboTax is great if you can use it for free. This includes the Free Edition for simple returns and the Deluxe Edition for military personnel in the E1-E5 pay grades. The software is easy and accurate, so filing for free is worth your time.

If you’re self-employed and want to try QuickBooks Self-Employed, paying the fee for TurboTax is worth it to get the free subscription.

Any other filers should check out the competition. TurboTax is far from the cheapest option, but it’s still comparable.

To be fair, it’s worth starting with the Free Edition. You don’t have to pay until you file, so you can see exactly what your fees will be. You can then complete your return somewhere else and compare the fees for your exact situation.

Pros and Cons:

Pros:

Turbotax Credit Score Free

- Free Edition: File both federal and state returns for free if you have a simple tax return.

- Cryptocurrency: TurboTax addresses cryptocurrency transactions, something many tax preparation companies are still trying to understand.

- TurboTax Live: For a fee, a tax expert will help you do your taxes and will review your tax return before it’s filed.

Cons:

- Expensive: If you can’t use it for free, you can find cheaper software somewhere else.

Summary

TurboTax offers accurateand user-friendly software. It’s a steal if you qualify to use it for free.

Their optional add-ons are some of the best in the business, spanning everywhere from audit representation to identify monitoring.

If you’re looking for the cheapest tax preparation software out there and don’t qualify for the Free Edition, you’re in the wrong place. TurboTax is solid software, but it can be pricey. Shop around at places like FreeTaxUSA or H&R Block to see if you can get a better deal.

Consider how much you value your time. Check which version of TurboTax you need and how many add-ons you include.

If you’re still unsure whether or not TurboTax is a good fit for you, try it for free. You don’t have to pay anything until you’re ready to file, so you can see your refund and your fees before you decide. There are so many tax situations out there, so the best way to find the perfect fit for you is to explore.

Experimenting with tax software is about as fun as watching your little brother trim his toenails, but at least it’ll save you time and money in the long run.

© Drazen Zigic / Getty Images/iStockphoto Young disabled freelance worker working on a computer while being with his dog at home.Now that the calendar has turned over to 2021, most people are likely in the process of realizing their New Year’s resolutions were wildly unrealistic — and that it’s time to file their taxes again. Fortunately, there is an abundance of ways to file your taxes now. You can do your taxes online and even avoid paying an accountant by logging in to free tax software platforms. And the variety of options means you can find the right program for your needs. After all, the best tax software for self-employed contractors is not necessarily going to be the same as the best tax software for small-business owners, professionals or even tax preparers.

Popular Searches

Exclusive: Americans’ Savings Drop to Lowest Point in Years

Here’s a closer look at some of the options for the best online tax software available in 2021 so you can make an informed decision about the best way to file your taxes.

| Best Tax Software for 2021 | |||

| Tax Software | Forms Accepted for Free Version | Cost for Federal Return – Paid Version | Cost for State Return – Paid Version |

| TurboTax | Form 1040 | $40 | $40 per state |

| H&R Block | 45 different forms, including 1040 and 1099 forms | $29.99 | $36.99 per state |

| TaxAct | Form 1040 | $24.95 | $44.95 per state |

| TaxSlayer | Form 1040 | $17 | $32 per state |

| Credit Karma Tax | All common forms and schedules supported | Free | Free |

TurboTax Review

- Best for: Complex returns

TurboTax is probably the best-known tax preparation company, but it’s also among the most expensive. It offers some great features that make it easy to use, though, such as the ability to file your taxes on any device, including your phone. You can even save time by entering your W-2 information simply by snapping a picture of the document.

TurboTax guarantees you’ll receive the maximum refund or it will refund the purchase price. The company also guarantees that all calculations will be 100% accurate or it will pay any IRS penalties and interest, and year-round audit support is part of the purchase price. Another helpful feature of TurboTax is TurboTax Live, which allows you to talk to an expert live on screen.

Important: Biden Wants to Shut Down Credit Bureaus – What Would That Mean for You?

TurboTax Pricing

Depending on the software version you choose — and what sort of deal is being offered on the normal purchase price — you could pay upward of $150 to do your taxes through TurboTax. Here’s how much using TurboTax software will cost you:

TurboTax Online Versions

- Free Edition: $0 — designed for those using Form 1040

- Deluxe: $40, plus $40 per state — designed for those whose taxes include mortgage or property tax, itemized deductions, deductible donations, etc.

- Premier: $70, plus $40 per state — designed for filers with investments and rental property

- Self-Employed: $90, plus $40 per state — designed for small-business owners and independent contractors

Turbotax

TurboTax Downloadable and CD Versions

- Basic: $40, additional $40 per state, plus $20 for state e-file; free federal e-file

- Deluxe: $70, one free state, $40 for each additional state; $20 to e-file state return

- Premier: $100, one free state, $40 per additional state; $20 to e-file state return

- Home & Business: $110, one free state, $40 per additional state; $20 to e-file state return

Pros of TurboTax

- Comprehensive coverage of tax issues

- Live help

- Option to pay for TurboTax service out of your refund

- Guides you through recent tax changes

- Imports last year’s TurboTax data

- Easy to use

Cons of TurboTax

- Costs more than some competitors’ software

- Some forms and schedules not supported in all versions

Avoid: 30 Things You Do That Can Mess Up Your Credit Score

H&R Block Review

- Best for: Tax novices who might need in-person support

Another familiar name in the tax-preparation game, H&R Block’s online software offers many great features, such as importing your income information from your prior year’s tax return, even if you used a different tax preparer, so you don’t have to enter all the information again. H&R Block also guarantees that you’ll receive the maximum refund possible. It also allows you to use its software to amend your return without any additional charges. Plus, it will pay up to $10,000 if you incur extra penalties or interest because of a software miscalculation, and will support you in the event of an audit.

H&R Block Pricing

The H&R Block fees for filing start at $29.99, but there’s a free version you can use instead. Here are details on the cost of different versions:

H&R Block Online Versions

- Free: Free federal and state returns — designed for first-time tax filers or simple tax returns

- Deluxe: $29.99 federal, $36.99 for each state return — designed for homeowners with deductions

- Premium: $49.99 federal, $36.99 for each state — designed for investors, freelancers and contractors

H&R Block Downloadable Software Versions

- Basic: $19.95 plus $39.95 for state software; $19.95 per state for additional state e-file

- Deluxe: $44.95; includes one state with additional states for $39.95 each, $19.95 for additional state e-file

- Premium: $64.95; includes one state with additional states for $39.95 each, plus $19.95 for additional state e-file

- Premium & Business: $79.95; includes one free state with additional states for $39.95 each and $19.95 for additional state e-file

Pros of H&R Block

- Option to pay for service from your refund

- Insights from The Tax Institute on tax changes and strategy

- Brick-and-mortar locations available

Cons of H&R Block

- Relatively high prices for federal and state returns

Don’t Forget: The 6 Most Important Tax Deductions You Need to Claim

TaxAct Review

- Best for: Filers seeking low-cost options

TaxAct offers a range of online and downloadable tax prep products, from free filing up to its premium versions. You have unlimited access to support when filing your return, but you must call when TaxAct is open. TaxAct doesn’t have around-the-clock customer support, but it is open for service on weekends.

TaxAct Pricing

TaxAct has five online versions and four software versions to choose from.

TaxAct Online Versions

- Free: Free federal and state returns and e-filing — designed for simple returns using basic Form 1040

- Deluxe: $24.95, plus $44.95 per state return — designed for homeowners and filers with deductions, credits and adjustments

- Premier: $34.95, plus $44.95 per state return — designed for filers with investments, rental property and prioritized support needs

- Self Employed: $64.95, plus $44.95 per state return — designed for self-employed filers, sole proprietors and independent contractors

TaxAct Downloadable Versions

- Basic: $19.95, includes five free federal e-files; state return is $50

- Deluxe: $99,95; includes five federal e-files and one state return

- Premier: $109.95; includes five free federal e-files and one state return

- Self-Employed: $119.95, includes five federal e-files and one state return

Pros of TaxAct

- Competitive online pricing

- Version specifically geared toward freelancers

- Guaranteed price

Cons of TaxAct

- Support not available 24/7

Related: How to File Self-Employment Taxes

TaxSlayer Review

- Best for: Filers who want live phone support

TaxSlayer offers five different online products for filing your income tax returns. For its Simply Free option, as long as you use Form 1040 you don’t have to pay for your federal and first state returns. All products offer live phone support. If you want features like audit assistance, Ask a Tax Pro, priority support, or live chat support, however, you’ll need to use the Premium version.

With Simply Free, you can also compare your return with your prior return to see how your numbers have changed and make sure you didn’t miss anything.

TaxSlayer Pricing

Check out the pricing on this affordable option for filing your taxes. You’ll pay $0 for the Simply Free version and from $17-$47 for the other three options.

TaxSlayer Online Versions

- Simply Free: Free federal and first state filings — designed for filers using a Form 1040

- Classic: $17, plus $32 per state return — includes “all tax situations”; can import last year’s return

- Premium: $37, plus $32 per state return — includes all the features of the Classic edition, plus priority customer assistance

- Self-Employed: $47, plus $32 for first state return — best for taxpayers with self-employment income

Pros of TaxSlayer

- Lower price

- Prepare from any laptop or mobile device

Cons of TaxSlayer

- No live chat for free or classic version — email and phone help only

- Only available online

For Freelancers: How To Calculate Estimated Taxes

Credit Karma Tax Review

- Best for: Credit Karma members with simple returns; filers looking to avoid paying fees

For truly free tax service, look no further than Credit Karma Tax. Credit Karma doesn’t support all income tax forms, but it covers many of the important ones and charges nothing for the service. Credit Karma does not support certain forms and situations, including multiple state returns, part-year resident state returns, foreign earned income, married filing separately in community property states, and state-only returns. Returns with any of these components can’t be accommodated. To begin, you must sign up to be a Credit Karma member, which is free as well.

Turbotax Credit Score Reddit

Credit Karma Pricing

- Credit Karma returns are free.

Credit Karma Online Version

- Free: Credit Karma doesn’t charge for its tax product.

Pros of Credit Karma

- Free

- No upsells

- Customer support team

Cons of Credit Karma

- Some filings not supported

- Must sign up for Credit Karma

- Not available for download

Read: What You Need to Know When Filing Your Tax Return This Year

Decide If Online Filing Works for You

Whether you file a personal tax return or own a small business, there is an online tax filing service or tax software that will enable you to file taxes online this tax season. Even the best tax service programs won’t do all the work for you, though. If you’re not confident in your ability to navigate tax software, call a professional to help you figure out how to file taxes, or seek out free tax assistance that is offered in many cities and towns.

More From GOBankingRates

Cynthia Measom, Terence Loose, Laira Martin, Michael Keenan and Ruth Sarreal contributed to the reporting for this article.

This content is not provided by the companies mentioned. Any opinions, analyses, reviews or recommendations expressed in this article are those of GOBankingRates alone and have not been reviewed, approved, or otherwise endorsed by TurboTax, H&R Block, TaxAct, TaxSlayer or Credit Karma.

Prices represent the regular cost of the products mentioned as of Feb. 12, 2021. Sale prices might vary.

My Credit Score

Last updated: Feb. 12, 2021

This article originally appeared on GOBankingRates.com: Best Tax Software and Services: Credit Karma to TurboTax