- Intuit Payroll Api

- Intuit Payroll Ach

- Intuit Payroll Login

- Intuit Payroll View My Paycheck

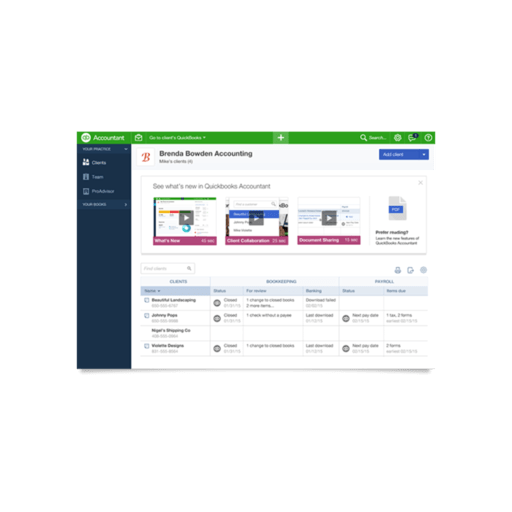

- Intuit Payroll For Accountants

- Intuit Payroll Customer Service

Overview

Intuit Online Payroll is a Commercial software in the category Home & Hobby developed by Intuit.

The latest version of Intuit Online Payroll is currently unknown. It was initially added to our database on 09/19/2008.

Everything Intuit. The feature you've requested is temporarily unavailable Make sure your browser has Javascript and cookies enabled. If the problem persists you can clear your cache and cookies and then restart your computer, or try using a different browser. Payroll Employee Portal Experience - Intuit. Attention employers: Intuit Online Payroll for mobile is now QuickBooks Payroll. With your QuickBooks Online account, you can now run payroll, pay.

Intuit Online Payroll runs on the following operating systems: Windows.

Intuit Online Payroll has not been rated by our users yet.

Write a review for Intuit Online Payroll!

| 04/24/2021 | Fake Voice 7.387 |

| 04/24/2021 | Kate's Video Toolkit 8.387 |

| 04/24/2021 | Falco Watcher 13.1 |

| 04/24/2021 | Kate's Video Joiner (free) 5.387 |

| 04/24/2021 | Webcam and Screen Recorder 8.1.118 |

| 04/23/2021 | Update for Chromium-based browser Vivaldi to 3.7.2218.58 |

| 04/23/2021 | The best popular free image viewers in 2021 |

| 04/20/2021 | Thunderbird 78.10.0 update fixes nine vulnerabilities |

| 04/19/2021 | Firefox 88 available for download |

| 04/16/2021 | Security updates for Chromium-based Brave, Vivaldi and Edge |

ViewMyPayCheck is here to help you to access employee pay stubs issued by the employer. It also provides payroll information that may include wages, taxes, gross pay, deductions – you name it.

About ViewMyPayCheck?

There might be question raised in your mind that what ViewMyPayCheck is?

The next-generation online payroll service developed by Intuit to get employee Paychecks – ViewMyPayCheck. There are many services available such as Paycom, UltiPro, Workday HCM, and Paylocity but its unique feature separates it differently. The best part is, it is associated with QuickBooks to offer a cloud-based payroll system.

You can access ViewMyPayCheck from computers/laptops, mobiles, and tablets. It is 100% safe and secure service.

Managing the company’s employee paycheques is not an easy job to do but Intuit ViewMyPaycheck automates pay stub processes quick and easy. It is able to debit current taxes and deductions on time.

Contents

- 5 How to Get Started With ViewMyPayCheck

- 6 Set Up a Payroll in ViewMyPaycheck

- 6.2 Step 2: Create a paychecks for employees:

- 8 Explore ViewMyPaycheck Features

How ViewMyPayCheck Works?

In this section, learn how does ViewMyPayCheck work and how one can use it.

Whether you’re an employer or an HR manager, it offers payroll services to manage their employment payment life cycle more convenient and secure. It can be suited to small or big scale businesses or companies.

QuickBooks and Intuit ViewMyPaycheck are working together for you to achieve your business goals – through this web portal.

W-2s can be made through QuickBooks by employers and they send to particular employees via Intuit. And that can be reached to employees a maximum of 48 hours. Learn how to access W-2s online.

Accountants have access to prepare payrolls in QuickBooks application and can be upload paychecks to employees intuit accounts. They have equal functionality as admins have, but they can’t add Administrator access to clients. Payroll Administrator can only have permissions to manage ViewMyPaycheck admins and give access to clients.

Basic Info

ViewMyPaycheck has Moved [Truth Explained]

ViewMyPaycheck portal has a new domain and redirected a new brand site, QuickBooks Workforce.

Despite the ViewMyPaycheck 2 version and several improvements, it has built a strong platform for business and companies over the past years and has moved to QuickBooks with a added features.

The best thing in QB is that it has a mobile applications for employer that makes easier and fast payroll service. It is complete accounting package to do financial transactions such as income, sales, taxes, payroll, W-2, W-3, W-4, etc.

How to Get Started With ViewMyPayCheck

Not sure how to start? Follow the instructions mentioned below from start to end. This module will guide employees to create and access ViewMyPayCheck with ease.

Important Notes for employees before going to register:

– Make sure to check whether your company is using ViewMyPaychek or not.– You must have your Social Security Number (SSN).

– You need to provide the net amount (Net Pay) of the last paycheck from your company.

Part 1: Accept Signup Invitation from Your Employer Via QuickBooks Workforce

We can’t create an account on QuickBooks Workforce (Formally known as ViewMyPaycheck) individually. So, your employer has an option to send a workforce signup invitation. You need to provide an email ID to your employer to get an invite link.

If you’re an employer then learn how to add employees to QuickBooks.

- As soon as your employer added your email address in QuickBooks Workforce’s employee list, you’ll get an invitation request to your Inbox from Intuit Services. If not receive the mail then make sure to check the spam folder or it may be because of the wrong email address.

- Open the email that you received from do_not_reply@intuit.com.

- Click on “Get access to paychecks”.

- Now, you’ll be able to redirect to the QuickBooks Workforce signup page.

Part 2: Signup for ViewMyPaycheck

- Once you’ve landed on the registration section, now you’ll need to create your credentials.

- To do this, Enter your valid email address.

- Create your desired password and rewrite it to confirm.

- Click on the Create Account.

- On the next page, enter your SSN (Social Security Number) and Net Pay amount.

- Click on Submit.

- That’s it.

This is how employees create an intuit account and now let’s get into sign in process.

Part 3: Login to ViewMyPaycheck

- Visit the QuickBooks Workforce homepage (https://workforce.intuit.com).

- Enter your email address and password in the respective fields.

- Click on Sign in button.

- Now, jump into your dashboard and manage our paychecks or pay stubs.

Side Note: The login should be applicable only for those who have already account in it. If not, kindly reach out to part 2 explained above.

Set Up a Payroll in ViewMyPaycheck

QuickBooks Desktop is a simple payroll tool where employers can create and send pay stubs to intuit first and then to workers. Here I’ll let you know how to process payroll with a step-by-step guide. Please follow the below steps as given below without fail.

Step 1: Login into your QB Intuit Account:

If you’re an administrator or an employer then you simply enter your credentials to perform these functions. You only have permission to run a payroll.

- Visit the login page from here.

- Enter your User ID or email address in the first filed.

- Now, enter your password in the second field.

- Click on the Sign In button.

Step 2: Create a paychecks for employees:

Before going to submit the payroll information to intuit, you should create a paychecks for your employees using scheduled or unscheduled payroll run feature.

You might confuse between scheduled and unscheduled payroll types. But, don’t worry about it because these two can be used according to the employer’s situation.

Create Paychecks using QB Online Payroll

- In the Quickbooks, visit the Workers from the left side menu and click on employees.

Optional for Scheduled payroll:

To Create an unscheduled payroll, click on the ▼ dropdown and select Bonus only, Commission only, or benefits only from the list. Next, click on As net pay or As gross pay. Use this quote area when you want to run unscheduled payroll and next follow the respected steps below.- Click on the Run Payroll option.

- In the Bank Account, select the Checking feature.

- Choose and select the Pay period and Pay date.

- Now, select the employees from your list. To remove the particular employees for this paycheck then simply uncheck them.

- Enter custom payroll information such as Pay Method, Salary, Regular Pay Hours, OT Hrs, memos, etc.

- Once you’ve done this, click on Preview Payroll.

- If everything looks correct then you good to go. Click on Submit Payroll.

- Finally, your payroll is run and done.

Create Paychecks by Intuit Online Payroll

This method is quite similar to the above one but using the Intuit online payroll service. You may feel some difference in user interface and options. This is easy and quick method to create paychecks.

- In this Intuit Online Payroll, visit the Payday option.

- Click on the Pay Schedule.

- Choose the type of check you want to use from Regular Check (Scheduled). and Bonus Checks, commissions, Fringe benefits (Unscheduled).

Intuit Payroll Api

- Make sure to select the employees.

- Give the paycheck information.

- Click on Create Paychecks.

- Now, check out the amounts and payment methods.

- Then, click on Approve paychecks.

Create Paychecks using QB Desktop Payroll

It is helpful for the people who are using the QuickBooks Desktop application.

- In QB Desktop’s header menu, go to Employees -> Pay Employees.

- Now, Choose the check type from scheduled payroll, unscheduled payroll, or termination check.

- Now, enter payroll information: Pay period ends, check date, bank account, and balance.

- Next, click on Check All to select all the employees.

- Click on Open Paycheck details…

- Enter the appropriate information such as Hours, rate, and Hourly.

- After reviewing each employee payroll info.

- Click on Save & Next.

- Click on the Save & Close button to get back to the payroll screen.

- Now, Click the Continue button.

- At last, tap on Create Paychecks option.

I hope you’re created the Paychecks successfully using the above three methods. Let’s learn how to send payroll to intuit servers.

Step 3: Send Payroll to intuit ViewMyPaycheck:

- Open QuickBooks Desktop.

- Go to Menu, Employee >> Send Payroll Data.

- Make sure to check all the data from “items to send” before going to the process.

- Tap on Send All.

- Now, it will ask you to enter your PSP (Payroll Service PIN).

- Tap on OK.

- To see the confirmation messages, visit the Items Received -> View.

- You can save or print these reports for future reference.

- Tap on Close.

How to View W2 and Paychecks in ViewMyPaychecks

Online access to the paychecks & w2s for every employee can be available through the QB workforce of ViewMyPaycheck.

Intuit Payroll Ach

Let’s see how to download, view, and print your paychecks.

- Login to Intuit workforce online portal.

- Go to the Paychecks tab.

- Select to view the latest and prior paychecks details.

- Tap on Download to save/print.

For W2:

- Click on the W2 tab.

- Now, you can see a list of W2 forms(W-2 copies B, C, and 2 from) sent by your employer.

- Click to view or download W2 forms.

Explore ViewMyPaycheck Features

A lot of benefits hidden in this service that you need to explore a bit. We’ve listed you the best features and functions by intuit viewmypaycheck.

Easy Payroll process

VIewMyPaycheck service will automatically streamline the payroll process without hassle. All you need to do is to enter the appropriate information into the online portal including pay rate, hours worked, deductions. Once you’ve chosen the pay period then it calculates the hours worked, net pay, gross pay.

For every pay period, the employer should input this information; How often do you pay? how much do you pay? After submitting this info to intuit, employees will get paychecks as an output to their dashboard. If you want to set the automatic payroll then create a pay schedule. Remember that, there is no bonus and commissions in scheduled payment. All this can be done within minutes.

Payroll Taxes

There are various standards of payroll texes to be filled along with paychecks. They are CA- Disability Employee, Social security employee, Medicare Addl taxes, CA-withholding, and Federal withholding.

W-2 & W-4 forms

Employers can reports year-end earning and deduction to the employees using the W-2 form provided in ViewMyPaycheck. Also, employees can still request tax withhold from their wages using W-4 form.

Download

Select the pay period and download the digital copy of your pay stubs to the computer or mobile. You can take the printout for paper reference using that PDF formatted file.

Notification

Whenever a new payroll runs you’ll get a notification to employee registered email address within seconds.

Intuit Payroll Login

Filter

View the prior paychecks by choosing particular time period using ‘year to day’ filter.

Mobile App

Intuit offers its users to download the ViewMyPaycheck app for Android and iOS. So that users can access services faster and keep track of their paychecks easily.

FAQ

How do I reset my employee password?

Can’t login to ViewMyPaycheck? You can reset your password by receiving a recovery link to email, OTP to registered phone number, or User ID.

- Visit https://workforce.intuit.com/app/payroll-employee-portal-ui/ius/account-recovery.

By Phone Number:

- Enter a phone number associated with your account.

- Click Continue.

- You’ll get an OTP as SMS for your mobile, Please enter it.

- Now, create a new password.

Via Email:

- Enter your email address.

- Tap on Continue button.

- Open your mail’s inbox and check for password recovery link.

- Click on that link.

- Follow screen steps and create a new password.

User-ID:

- Enter your User ID.

- Click on Continue.

- Now, your password will be sent to your registered email or mobile number.

- Done.

If you still can’t sign or reset password for your account then try this advanced option. You’ll need to provide other questions about yourself.

- Go to “I forgot my user ID or password” page.

- Click on Try something else.

- Enter Last Name, Date of birth, Social Service Number, and ZIP code.

- Select Continue.

- If you gave the correct details then you can make new a password.

Is there a way to see which employees have signed up?

Yes! employers and admins can have a list of registered employees in their dashboard. To see your employees please log in to your account, go to the menu at the top, and select employees.

How to become an admin?

As a client or employee, you can ‘t become an admin yourself. It is only possible for the current administrator of your company. If you’re a current administrator and want to make your client as an admin then your search ends here. See how?

- Once you’ve logged in as an admin for your company in QuickBooks, please go to Employees option on the menu.

- Select the Manage Payroll Cloud Services.

- Be sure to check whether the ViewMyPayceheck is chosen in the Payroll Cloud services tab.

- Now, tap on Manage ViewPaycheck Admins at the bottom of the window.

- Again, you’ve to give your intuit credentials to load your company details.

- Click on Sign In.

- Now, it’ll take you to the Manage users window.

- Tap on Invite Other.

- Fill the form with email id, first name, and last name of that client/employee who wants to act as an admin.

- Tap on the Send button.

When you reached the invitation email open the link and follow the screen steps.

How to enable ViewMyPaycheck in QuickBooks?

In QuickBooks, visit this location (Employee > Manage Payroll Cloud Service) and turn on the ViewMyPaycheck feature.

How to signup for my company and add multiple companies to Intuit ViewMyPaycheck?

Intuit Payroll View My Paycheck

There are 2 ways to add companies to intuit;

Older method:

- Sign in to intuit account via workforce.intuit.com

- Open “View My Paychecks from another company” tab which is located at the top right of the dashboard.

- Enter the SSN and recent net pay amount of the new company.

- Done.

Intuit Payroll For Accountants

Newest method:

- Signup for QBO using this link.

- Select your region or country.

- Tap on any one option from Buy or Free 30-Day Trial.

- Choose your plan from this page.

- If you already have a QuickBooks Online account then Click on “Add Another Company”.

- Sign in with your username and password.

- That’s it

Intuit Payroll Customer Service

How to update employee address in QBO from ViewMyPaycheck?

- Open QBO and go to settings (gear icon) page.

- Click on Custom Form Styles.

- Look for your employee invoice document.

- Click to Edit.

- Open the Content tab.

- Immediately, that PDF doc will appear on the right side. Click the Edit icon.

- Tap on “+ Address” in the header.

- You can enter or modify the employee address here and submit it.

- Done.